Diwali Picks Report

Diwali Special - November 2021

Research Team | www.angelone.in

Diwali

Happy

Dear Friends,

Let me wish you all a very Happy Diwali and a Prosperous New Year!

As we head into the auspicious occasion of Diwali, the Nifty continues to hit new lifetime highs and even the

second Covid wave in Q1FY2022 did not have any significant impact on the markets. While the second Covid wave

briefly interrupted the recovery process, the impact was smaller than the first wave and high-frequency

indicators already point to a V-shaped recovery in the economy.

Markets were also supported by continued monetary and fiscal stimulus in developed economies. This resulted in

large FII flows into emerging markets including India as we received record flows of `2.7 lakh Cr in FY2021

including `2 lakh Cr in H2FY2021. While FII flows were robust last year, mutual funds witnessed outflows of

`39,327Cr.

However, the mutual fund outflows were compensated by an increase in direct retail participation. This was

reflected in 2.9Cr new demat account additions between Mar ’20 and Sep ’21 and has led to an increase in demat

penetration from 3.1% to 5.1%. I expect direct retail participation to increase significantly in the years to come

driven by new-age digital brokers like us who are leveraging technology to penetrate previously un-served

markets of Tier-II cities and beyond.

The US Fed in its latest FOMC meeting has announced that it will start with the tapering of bond purchases from

the end of 2021. This is leading to concerns that we may see FII outflows which will lead to a correction in the

markets like 2013. However, this time around India’s fundamentals are much better as compared to 2013 and

therefore it is unlikely that there will be any major pullout by FIIs though there will be a slowdown in inflows.

While we are already witnessing moderation in FII flows as compared to FY2021, mutual fund flows have turned

positive at over `53,325Cr in the first half of FY2022. Going forward I expect mutual fund flows will remain robust

which along with a continued increase in direct retail participation will more than make up for a slowdown in FII

flows and keep driving markets.

What is also giving me confidence is the significant increase in the pace of vaccination over the past few months

with India having achieved the landmark of administering over 100Cr doses. At the current rate, the entire eligible

population will be partially vaccinated by Dec ’21 which will limit the impact of any possible third Covid wave on the

economy. Therefore looking at the current environment I am confident that the economy will continue to improve

from here on and we can look forward to an even brighter Diwali next year.

So, let’s continue the exciting journey while celebrating this auspicious occasion.

Happy Diwali once again!

Dinesh Thakkar

CMD, Angel One Limited

Strong economic recovery to support markets

The Indian economy has rebounded strongly post the second Covid wave with high-

frequency indicators pointing to a V-shaped recovery to pre-second wave levels. While

manufacturing had led in the initial phase of the rebound, gradual withdrawal in

restrictions has led to a strong rebound in the services sector since Aug '21. We expect

the economic recovery process to continue led by strong festive demand and continued

acceleration in the services sector. Significant progress on the vaccination front will

restrict the fallout from any possible third Covid wave. Going ahead, we expect banking

and consumer-facing sectors to drive the markets given an expected rebound in

earnings in H2FY2022. We also remain positive on the IT sector given the structural

up-shift in the medium-term growth trajectory for the sector. Although on a P/E basis the

Nifty is trading above its five-year average, ex of IT and RIL, the Nifty is still near its

five-year average which provides comfort.

Improvement in Covid situation and progress on vaccination are key

positives

The Covid situation in India has improved significantly as the new cases on a 7-day rolling

average are now at ~15,000 per day from the peak of ~4 lakh per day in May '21 despite the

withdrawal of restrictions. Significant progress has been made on the vaccination front

with over 75% of the eligible population being partially vaccinated. Going by the current

pace of vaccination it is estimated that the entire eligible population will be fully vaccinated

by the end of Dec ‘21 which will limit the impact of any possible third wave on the economy.

Domestic flows to make up for any slowdown in FII flows due to tapering

Given the strong rebound in the US economy and high level of inflation due to supply chain

issues, the US Fed has indicated that they will start with the tapering gradually from the end

of CY2021. Considering the gradual pace of tapering, it is unlikely that there will be any

major pullout by FIIs though there will be a slowdown in inflows. However robust mutual

fund flows along with a continued increase in direct retail participation will more than make

up for a slowdown in FII flows.

Banking, consumption, and select cyclical sectors to do well along

with IT

We expect the banking sector to lead the markets from here on given the strong rebound in

earnings in H2FY2022 due to the pick up in AUM growth and decline in provisioning. We also

expect sectors like aviation, consumer durables, hotels, multiplexes, and real estate to do

well on the back of strong earnings growth in H2FY2022 due to further reopening of the

economy and pent-up demand. We expect that the IT sector will also continue to do well

going forward despite significant rerating over the past year due to structural upshift in the

medium-term growth trajectory.

Key risks for the markets are 1) A bigger than expected third Covid wave in India which

impacts the recovery process 2) Further increase in global inflation from current levels

forcing central banks to tighten earlier than expected.

Company CMP (`) TP (`)

Auto

Ashok Leyland 143 175

Sona BLW Precis. 640 775

Ramkrishna Forg. 1,192 1,545

Suprajit Engg. 368 425

Banking

AU Small Finance 1,261 1,520

Federal Bank 102 135

HDFC Bank 1,653 1,859

Shri.City Union. 2,215 3,002

Chemical

P I Industries 3,000 3,950

Others

Carborundum Uni. 868 1,010

Stove Kraft 980 1,288

Safari Inds. 853 979

Sobha 765 950

Whirlpool India 2,230 2,760

Lemon Tree Hotel 53 64

Amber Enterp. 3,450 4,150

Source: Company, Angel Research

Note: Closing price as on 26th Oct, 2021

Top Picks

Top Picks Report November 2021

Diwali Special

November 2021 2

The Indian economy has staged a V-shaped recovery post-second wave

Since the past Diwali, India's recovery was set back by a quarter owing to the second wave

during Q1FY2022. However, the recovery was equally fast with the Indian economy staging

a V-shaped recovery. The mobility trends are reverting to pre-covid levels as per the google

mobility index where the retail & recreation indicator has reached 96% of baseline level,

public transport is up 3% from the baseline and the workplaces indicator suggests that the

“back to the office” theme is picking up.

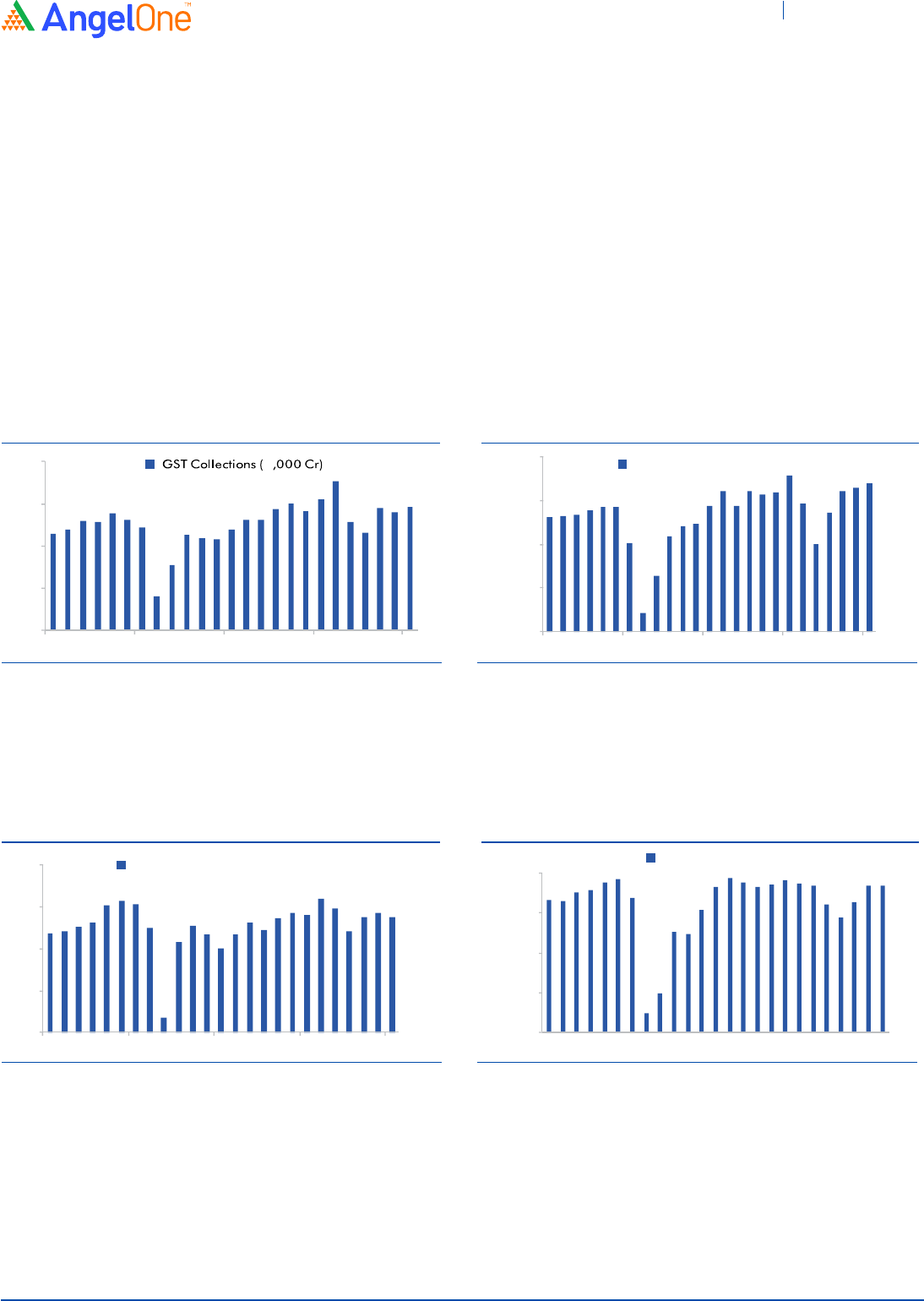

As for other leading indicators, the GST collections have also rebounded post the second

lockdown and are now above the pre-pandemic levels of 2019. E-Way bill generation has

been at the highest level since the start of FY2022 and the momentum is likely to pick up

which will get reflected in GST numbers to come.

High frequency indicators like GST and

E-Way bills are above pre pandemic levels

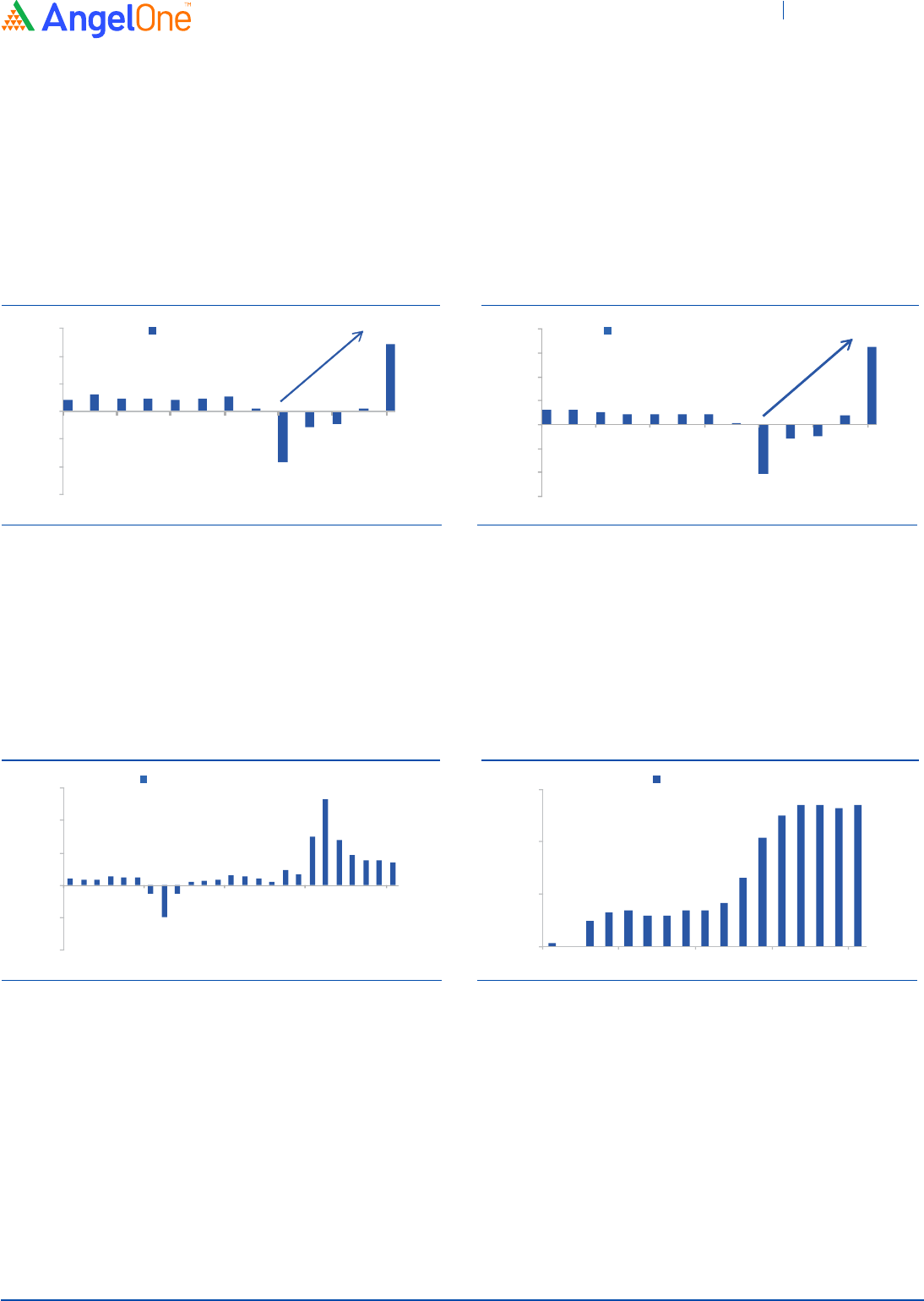

Exhibit 1: GST Collections above pre-pandemic levels

Source: GST Council, Angel Research

Exhibit 2: Sep E-way Bill Generation highest for FY22

Source: GSTN, Angel Research

Cement demand is expected to bounce back strongly post the monsoon months led by

higher government spending on infra projects and other construction activity. The PMI

numbers also point to a very strong recovery from the second wave lows in Q1FY2022.

Exhibit 3: Recent volumes higher than 2019 levels

Source: Bloomberg, MOSPI, Angel Research

Exhibit 4: PMI points to strong recovery from 2nd wave

Source: IHS Markit, Angel Research

92

95

117

0

40

80

120

160

₹

52

57

68

0

20

40

60

80

Sep-19 Mar-20 Sep-20 Mar-21 Sep-21

E-way Bill Generation (Mns)

23.6

3.5

20.1

27.6

0

10

20

30

40

Aug-19 Feb-20 Aug-20 Feb-21 Aug-21

Cement Production (Mn Tonnes)

49.8

7.2

54.6

43.1

55.3

0

15

30

45

60

Sep-19 Mar-20 Sep-20 Mar-21 Sep-21

India Composite PMI

Top Picks Report November 2021

Diwali Special

November 2021 3

Sep-19 Mar-20 Sep-20 Mar-21 Sep-21

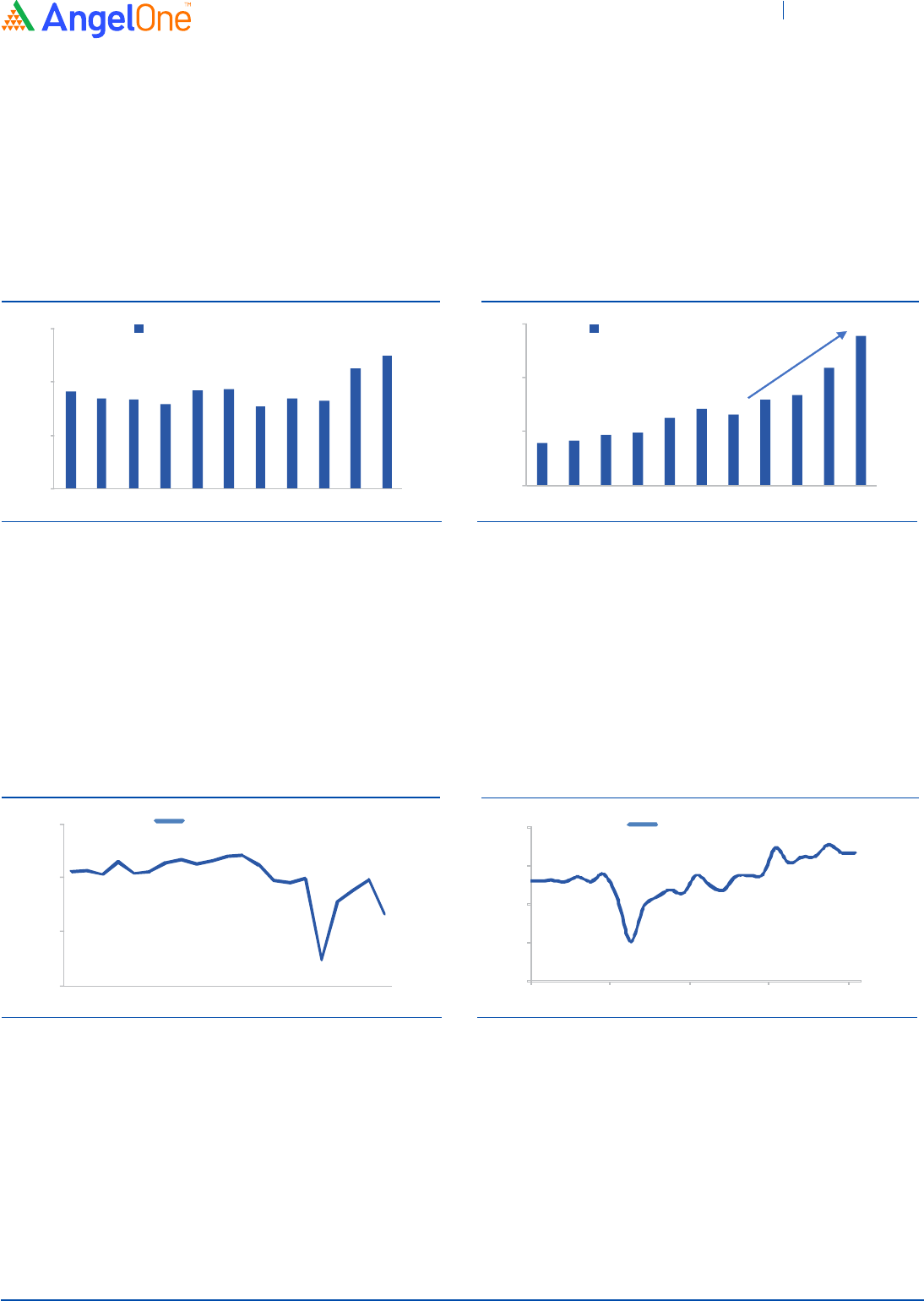

As for investing for future growth, the intent is visible from Government's Capex figures.

Central Government's Capital Expenditure as a percentage of Nominal GDP has improved

from 1.5% in FY2018 to 2.5% of FY2022 budgeted Estimates. Private sector Capex in

cement and steel sectors is already visible owing to strong demand and improving

profitability. Additionally, the PLI scheme is expected to boost private sector participation

where the environment is conducive with ample liquidity and low-interest rates.

Increase in Government Capex will

also help drive GDP growth over the

long run

Exhibit 5: Increased Govt. allocation to Capex…

Source: Budget Documents, RBI, Angel Research

Exhibit 6: …is also meaningful in absolute terms

Source: Budget Documents, RBI, Angel Research

Near-term threats are emerging from rising inflation and tapering by the US Fed. The pace

of inflation has been alarming due to global supply chain bottlenecks and a rise in input and

energy prices but the same is expected to cool off by Q4FY2022. As far as India is

concerned, the OBICUS survey suggests that the capacity utilizations have enough

headroom to improve to meet the broad-based improvement in demand which in turn

should help mitigate the impact on gross margins for corporate India due to higher input

costs.

Exhibit 7: CUs low; can address any uptick in demand

Source: RBI OBICUS Survey, Angel Research

Exhibit 8: Exports can become a growth driver for India

Source: GOI, Angel Research

Additionally, given the supply side and other issues faced by China, India is in a good

position to act as a substitute player and can benefit from the buoyant global demand

scenario. We therefore believe that Exports will be another growth engine for India going

forward.

1.8

1.5

2.5

0

1

2

3

FY12 FY14 FY16 FY18 FY20 FY22E

Capital Expenditure % of GDP

1.6

2.6

5.5

0

2

4

6

FY12 FY14 FY16 FY18 FY20 FY22E

Capital Expenditure (`Lk Cr.)

20% CAGR

76.1

69.4

60.0

40

55

70

85

Jun-16 Jun-17 Jun-18 Jun-19 Jun-20 Jun-21

Capacity Utilisation (%)

27.7

33.4

0

10

20

30

40

Sep-19 Mar -20 Sep-20 Mar -21 Sep-21

Exports (USD Bn)

Top Picks Report November 2021

Diwali Special

November 2021 4

Decrease in new cases, lower positivity rates, and progress on

vaccination will help to fully open up the economy

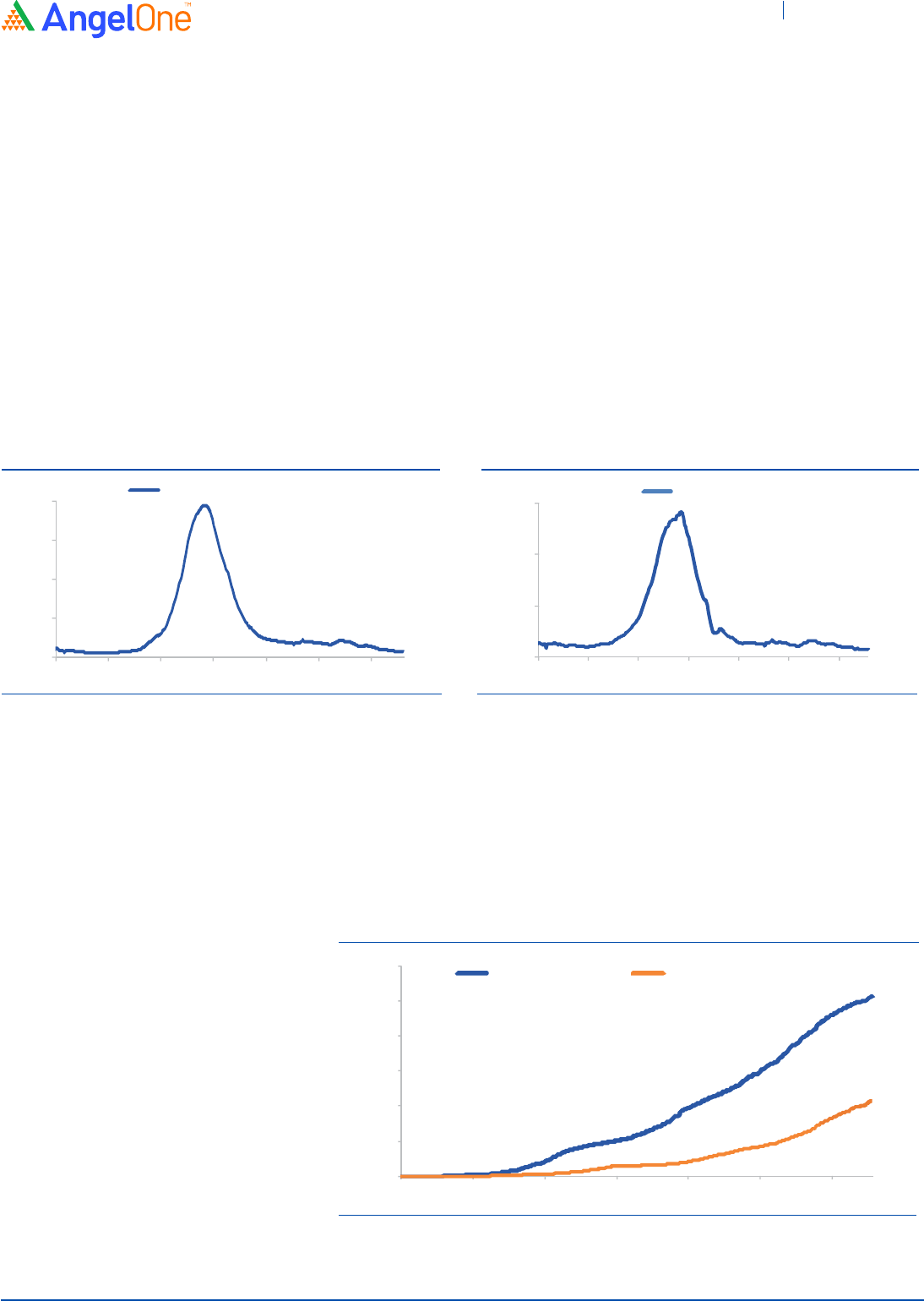

The covid situation in India has improved significantly over the last three months. From the

peak of ~4 lakh per day cases as seen during the peak of the second wave in May '21, the new

cases on a 7-day rolling average came down to ~24,000 by the end of Sep'21 and are now

averaging ~15,000 per day.

Although the contribution of key states like Maharashtra, Kerala, Tamil Nadu, Karnataka,

and Andhra Pradesh (AP) makes up for most of the new cases, the active cases in

Maharashtra, Karnataka, and AP continues to decline. More importantly, the positivity

rates have come down significantly in these states and India's overall positivity rate at 1.3%

is below pre-second wave levels while the 15 day lag Mortality rate is currently at less

than 2%.

Positivity rate at 1.3% is below

pre second wave levels of 1.6%

Exhibit 9: Decline in new cases despite unlocking

Source: GOI, Angel Research

Exhibit 10: Positivity rates are lower than Feb'21 levels

Source: GOI, Angel Research

While India was slow to start with the vaccination process there has been a significant step

up in the pace of vaccination since August as a result of which 51.2%/75% of the

total/eligible population has already received one dose as of 23rd of Oct'21. At the current

pace, India is expected to partially vaccinate its entire eligible population by Dec'21 which

would mitigate the impact of any possible third wave.

Significant progress on vaccination

reduces the risk of a third wave

Exhibit 11: Over half of India's population has been partially vaccinated

Source: GOI, Angel Research

0

1

2

3

4

Jan-21 Feb-21 Apr-21 May -21 Jun-21 Aug-21 Sep-21

7 Day rolling new cases (Lakhs)

1.6

22.7

1.3

0

8

16

24

Jan-21 Feb-21 Apr-21 May -21 Jun-21 Aug-21 Sep-21

Positivity Rate (%)

51.2

21.4

0

10

20

30

40

50

60

Jan-21 Feb-21 Apr-21 May -21 Jun-21 Aug-21 Sep-21

Partial Vaccination (%) Full Vaccination (%)

Top Picks Report November 2021

Diwali Special

November 2021 5

Strong US growth & high inflation trigger tapering by the US Fed

With restrictions being eased at the start of the calendar year, the US economy has seen its

sharpest rebound thanks to the USD1.9 trillion stimulus package in Mar '21. This led to a

sharp increase in demand for goods while services rebound started with the easing of

norms. As a result, the US GDP has now recovered to pre-pandemic levels led by

consumption.

US economy has rebounded to

pre pandemic levels led by consumption

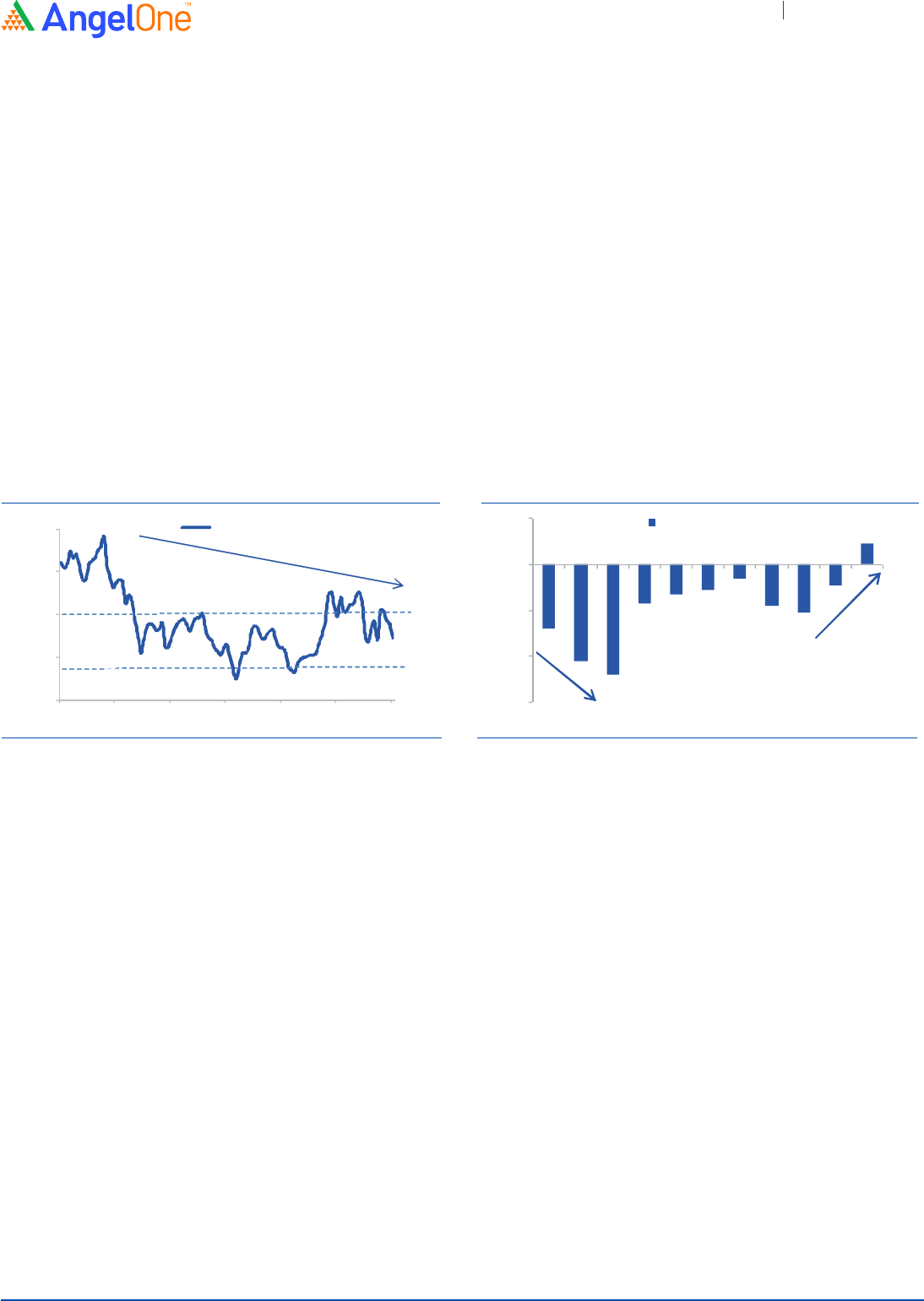

Exhibit 12: US GDP is back to pre Covid levels

Source: Bloomberg, FED, Angel Research

Exhibit 13: Driven by strong consumption growth

Source: Bloomberg, FRED, Angel Research

An increase in private wages and factors like Child Tax Credit payments starting in Jul'21

have also boosted income levels. As a result, Personal Consumption Expenditure has

sustained at recent highs which is reflected in the retail sales numbers; up ~16% higher

than the pre-Covid levels. Based on the current trends, the retail sales are showing

resilience but some of the rise in retail spending is also attributed to inflation.

Exhibit 14: Retail Sales continue to remain strong

Source: Bloomberg, Angel Research

Exhibit 15: Inflation at highest levels in last 13 years

Source: US BLS, Angel Research

It is evident that the US growth has bounced back strongly, and the demand is expected to

sustain. This along with the effects of higher energy price and supply chain related issues

have lifted inflation to its highest levels seen in the past 13 years. Given the high growth

rates and inflation, the US fed has indicated that they will start with the tapering of their

bond purchases from the end of 2021.

2.1

3.1

2.3 2.2

2.1

2.3

2.6

0.6

-9.1

-2.9

-2.3

0.5

12.2

-15

-10

-5

0

5

10

15

Jun-18 Dec-18 Jun-19 Dec-19 Jun-20 Dec-20 Jun-21

US Qtr GDP Growth YoY (%)

3.1

3.2

2.6

2.1 2.1

2.3 2.3

0.3

-10.2

-2.8

-2.4

2.1

16.2

-15

-10

-5

0

5

10

15

20

Jun-18 Dec-18 Jun-19 Dec-19 Jun-20 Dec-20 Jun-21

US Qtr Consumption Growth YoY (%)

4.0

6.0

53.4

13.9

-40

-20

0

20

40

60

Sep-19 Mar -20 Sep-20 Mar -21 Sep-21

US Retail sales growth YoY (%)

0.1

1.4

5.4

0

2

4

6

May -20 Sep-20 Jan-21 May -21 Sep-21

US CPI YoY (%)

Top Picks Report November 2021

Diwali Special

November 2021 6

However, tapering will be gradual and unlikely to disrupt markets

The minutes of the Oct Fed meeting indicate that the US Fed is most likely to announce the

start of the tapering in the Nov '21 FOMC meeting given the continued high level of inflation

and strong consumer demand.

This is leading to concerns that we are likely to see a repeat of 2013 when talks of tapering

led to a correction in Indian markets. However, the correction in Indian equities in 2013 was

more due to the twin balance sheet problem in India along with very high levels of Inflation.

India had a current account deficit of 4.8% in FY13 while CPI inflation too was well over 10%.

However, this time around India's fundamentals are much better as compared to FY13 as

we had a current account surplus of 0.9% in FY2021 as compared to a large deficit in

FY2013. Inflation is also significantly lower and has been below the 6.0% levels as

compared to double-digit inflation in 2013.

The US fed likely to announce

tapering in the Nov'21 FOMC meet

India's external situation is significantly

better as compared to 2013

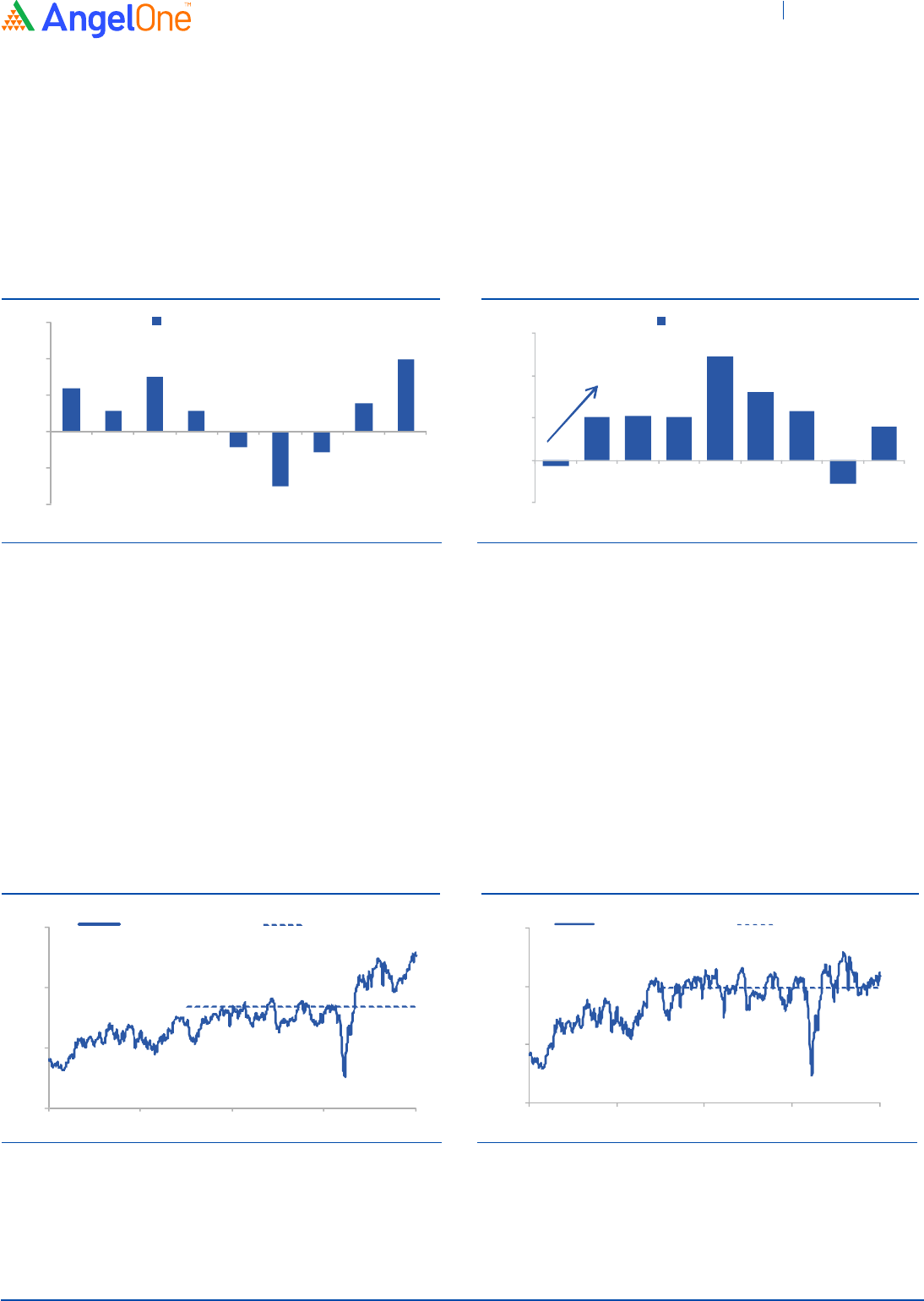

Exhibit 16: India Inflation has come down structurally

Source: Angel Research, Bloomberg, RBI

Exhibit 17: First CAD surplus for India in 17 years

Source: Angel Research, Bloomberg, RBI

Given the significant improvement in external position, we believe that India is in a much

better position to withstand any external shock arising from tapering as compared to 2013.

Moreover, the Fed has indicated that they will taper gradually and reduce their bond

purchases by USD 15bn from current levels of USD 120bn per month. The Fed has also

indicated that rate hikes are only going to start happening from the second half of the

calendar year 2022 once the tapering process is over.

Therefore, the tightening process is going to be a gradual one and will allow the markets to

get accustomed to lower liquidity gradually thus ensuring that there is no abrupt sell-off in

global markets. Hence global liquidity is expected to remain reasonably strong in FY2022

and will ensure that we keep getting some amount of FII flows for the rest of FY2022.

Gradual tapering will allow markets

to get accustomed to lower liquidity

11.5

4.4

0

3

6

9

12

Sep-12 Mar -14 Sep-15 Mar -17 Sep-18 Mar -20 Sep-21

CPI Inflation (%)

-2.8

-4.2

-4.8

-1.7

-1.3

-1.1

-0.6

-1.8

-2.1

-0.9

0.9

-6

-4

-2

0

2

FY11 FY13 FY15 FY17 FY19 FY21

CAD (% of GDP)

Top Picks Report November 2021

Diwali Special

November 2021 7

Domestic liquidity will make up for any slowdown in FII flows

While we expect FII flows to be stable for the rest of FY2022 and moderate from the

`2.7 lakh Cr. inflows in FY2021 we expect domestic flows will be robust. Mutual fund flows

that had turned negative in FY2021 have bounced back strongly in the first half of FY2022.

We expect Mutual fund flows to remain strong going forward which will make up for any

possible slowdown in FII flows.

Mutual Fund flows have turned

positive in 1HFY2022

Exhibit 18: MF flows have turned positive in 1HY22

Source: Angel Research, AMFI, SEBI

Exhibit 19: MF Flows to drive markets going forward

Source: Angel Research, AMFI, SEBI

Valuations optically higher due to rerating in few sectors and low

corporate profit to GDP ratio

At current levels, the Nifty is trading at a P/E multiple of 22.7x on rolling one-year

consensus earnings which is well above the past five-year average of 18.4x. This is largely

on account of sharp rerating in the IT sector and Reliance Industries which have a

combined weight of ~28% in the Nifty.

The IT sector and RIL have witnessed a rerating over the past year due to structural

changes in underlying fundamentals which will put them on a higher growth trajectory in

the medium term.

Exhibit 20: Nifty trading at premium to 5 year average

Source: Angel Research, Bloomberg

Exhibit 21: Nifty Ex IT & RIL is still inexpensive

Source: Angel Research, Bloomberg

23.7

11.4

30.1

11.4

(8.9)

(30.1)

(11.7)

15.6

39.7

(40)

(20)

0

20

40

60

Q2FY20 Q4FY20 Q2FY21 Q4FY21 Q2FY22

Mf Flows ( `,000 Cr)

(9)

71

74

70

171

112

82

(39)

55

(70)

0

70

140

210

FY14 FY16 FY18 FY20 1HFY22

Mf Flows (`,000 Cr)

22.7

18.4

10

15

20

25

Oct -13 Oct -15 Oct -17 Oct -19 Oct -21

Nifty one year Fwd P/E 5 year avg.

14.5

13.9

8

11

14

17

Oct-13 Oct -15 Oct -17 Oct -19 Oct -21

Nifty P/E ex IT and RIL 5 year avg

Top Picks Report November 2021

Diwali Special

November 2021 8

Excluding RIL and the IT sector, the Nifty is trading at a P/E multiple of 14.7x. This is near its

last 5-year historical average of 13.9x, which looks reasonable and provides comfort.

Therefore we believe that the Nifty will continue to trade at a premium to historical

averages.

Another reason why the markets appear to be expensive on a P/E basis is due to the

significant drop in corporate profit to GDP ratio between FY10-FY20. India's corporate

profitability growth at 5.8% CAGR during the period was significantly below the nominal

GDP growth of 12.4% CAGR during the same period.

Excluding IT and Reliance Nifty

is still inexpensive

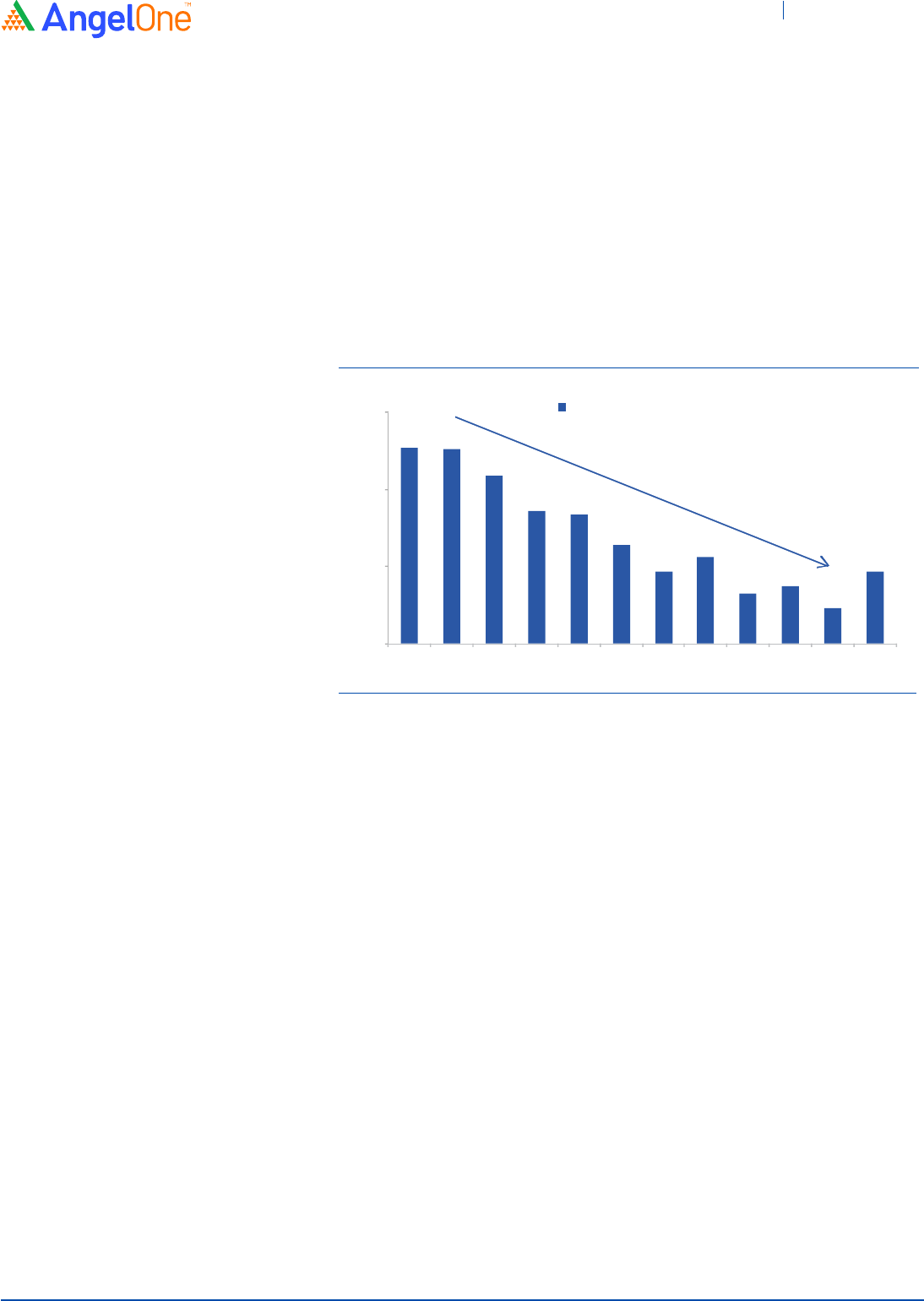

Exhibit 22: Corporate profit to GDP ratio has bottomed out

Source: Angel Research, Bloomberg, Capitaline

While high inflation and interest rates impacted profitability growth between FY10-FY15,

multiple structural reforms like Demonization, GST, RERA, and clean-up of banking sector

NPAs impacted profitability growth between FY15-FY20.

This resulted in corporate profitability to GDP falling from 4.5% in FY2011 to 2.5% in

FY2020. However, with all the reforms related issues behind us, corporate profitability has

started to improve. Profits for BSE 500 companies have grown by 15.4% in FY2021

despite the Covid crisis which has resulted in corporate profit (BSE 500) to GDP ratio

improving to 2.9%.

Strong acceleration in GDP growth over the next 2-3 years along with improving corporate

profitability should lead to a further increase in corporate profit to GDP ratio. Therefore as

earnings growth catches up over the next few years valuations will start to appear more

reasonable.

Earnings growth to catch up

over next 2-3 years

4.5

4.5

4.2

3.7

3.7

3.3

2.9

3.1

2.6

2.7

2.5

2.9

2.0

3.0

4.0

5.0

FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21

BSE 500 Profit (% of GDP)

Top Picks Report November 2021

Diwali Special

November 2021 9

Continued economic recovery and liquidity will support markets

The pace of recovery of the Indian economy has surprised everyone with high-frequency

indicators indicating that economic activities are already above the pre-second wave

levels. Festive demand is also expected to be strong which should provide further impetus

to the recovery process.

Inflation is expected to remain below the 6.0% levels well into Q1FY2023 which will allow the

RBI to continue with its accommodative stance. Hence we expect that the RBI will keep the

repo rate at the current 4.0% levels for the rest of FY2022 thus helping the economic

recovery process. Therefore we expect India to achieve 8.5% to 9.5% GDP growth in line

with consensus estimates.

We expect earnings recovery to continue in H2FY2022 led by banking, consumption, and

service oriented sectors due to continued improvement in the underlying economy which

along with strong domestic liquidity will support markets.

Banking, consumption, and select cyclical sectors to do well

along with IT

The Banking sector had been one of the worst impacted sectors due to the second Covid

wave which had led to another round of spike in NPAs and credit costs in Q1FY2022.

However going by the initial trend in the Q2FY2022 results, it seems like the worst is over

for the sector with larger banks reporting improvement in asset quality. We expect a pick-

up in AUM growth along with significant improvement in asset quality and decline in credit

costs in H2FY2022, which should lead to a rerating for the sector.

While we expect the banking sector to lead the markets from here on, we also expect

sectors like aviation, consumer durables, hotels, multiplexes, and real estate will also do

well going forward due to the reopening of the economy and pent up demand. We are also

positive on CVs, cement, and building materials given that they will be the biggest

beneficiaries of the Government's focus on infrastructure and housing.

We also believe that the IT sector will continue to do well going forward despite significant

rerating over the past one year given the structural upshift in growth trajectory over the

next 3-5 years.

Low interest rates to help the

economic recovery process

We expect the banking sector to

post strong growth in H2FY2022

We expect sectors like aviation,

consumer durables, hotels, and

real estate to do well going forward

Top Picks Report November 2021

Diwali Special

November 2021 10

Top Picks Report November 2021

Diwali Special

Diwali Picks

Stock Info

CMP 102

TP 135

Upside 32%

Sector Banking

Market Cap (`cr) 21,867

Beta 1.5

52 Week High / Low 106/50

n Federal Bank is one of India's largest old generation private sector banks. At the end of

H2FY2022 the bank had total assets of ₹2.06 lakh Cr with deposits of ₹1.72 lakh Cr and a

loan book of ₹1.34 lakh Cr

n Federal Bank has posted a good set of numbers for Q2FY2022 as NII / advances

increased by 7.2%/9.5% YoY. Provisioning for the quarter was down by 58.6% YoY as a

result of which PAT was up by 49.6% YoY. GNPA and NNPA ratio improved to 3.25% and

1.12% while restructuring went up by ~75bps qoq to 2.6% of advances

n Overall asset quality for the quarter improved in Q2FY2022 which was better than our

expectations. We expect asset quality to improve further in H2FY2022 given continued

opening up of the economy. We expect the Federal bank to post NII/PPOP/PAT CAGR of

22.8%/23.7%/23.2% between FY2020-23 and remain positive on the bank

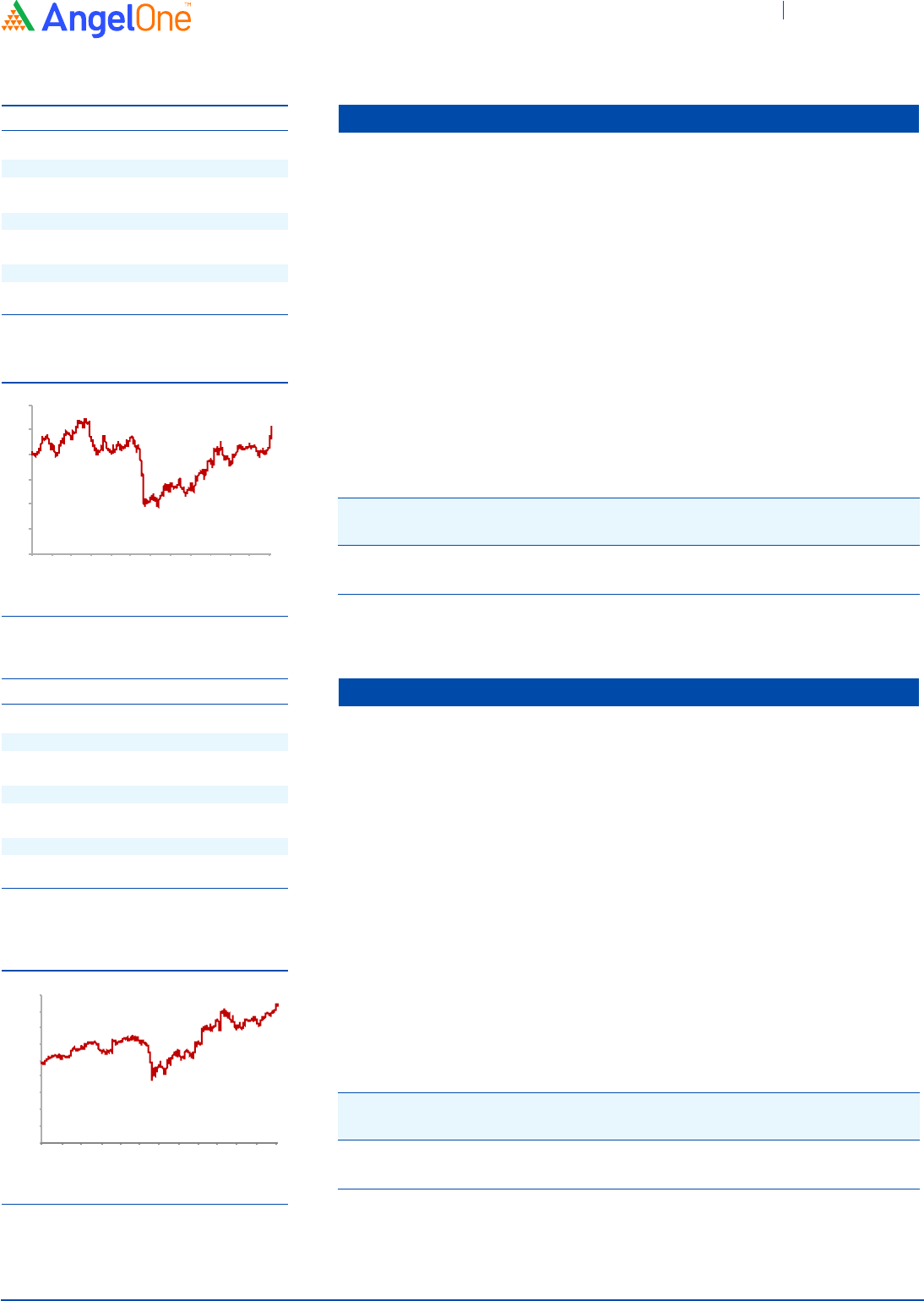

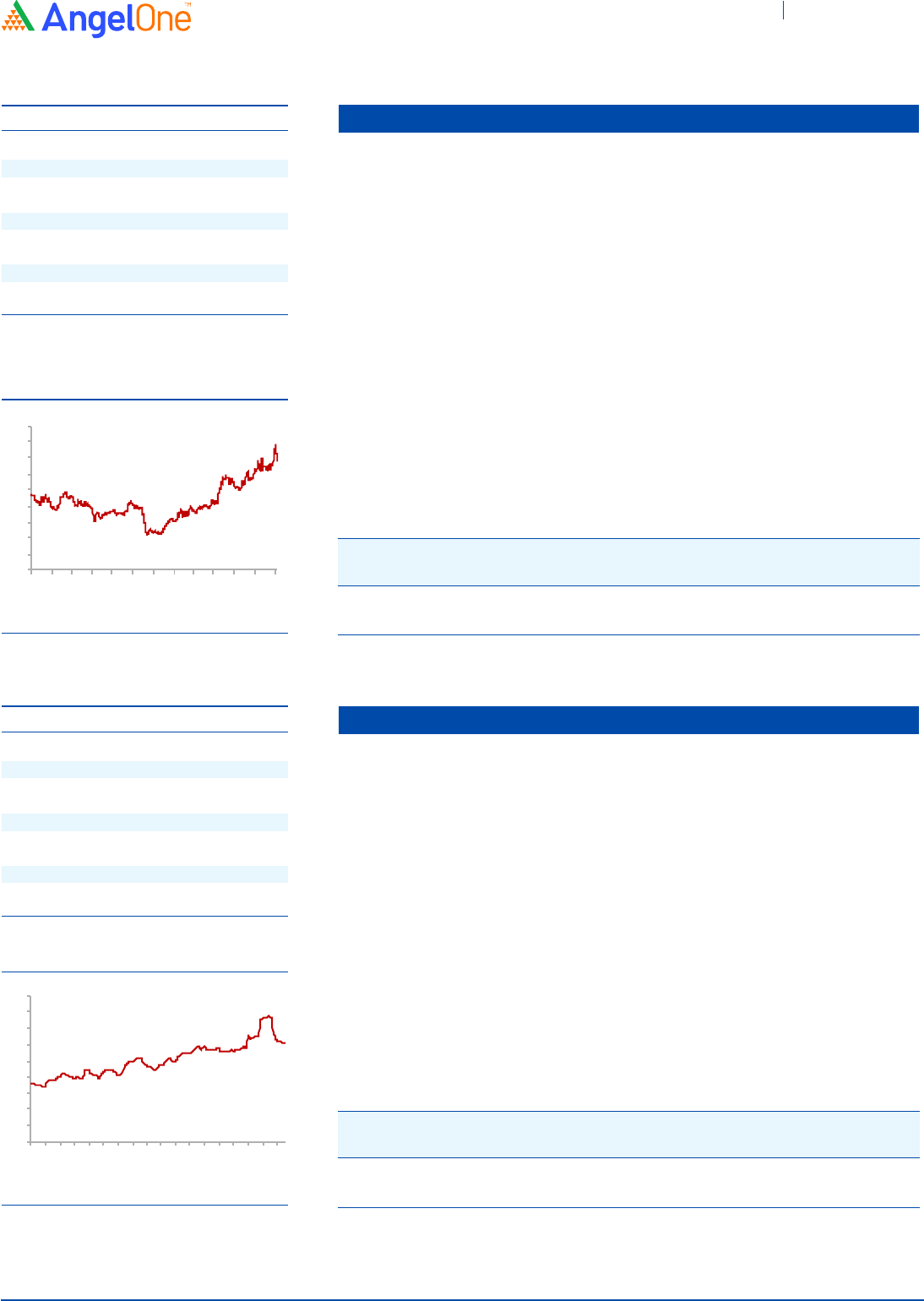

Federal Bank

3 year-Chart

Source: Company, Angel Research

Key Financials

Source: Company, Angel Research

Y/E NII NIM PAT EPS ABV ROA ROE P/E P/ABV

March (`cr) (%) (`cr) (`) (`) (%) (%) (x) (x)

FY2022E 6,604 3.1 2,107 10.6 84.3 1.0 12.3 9.6 1.2

FY2023E 8,612 3.4 2,884 14.5 97.7 1.1 14.7 7.0 1.1

-

20

40

60

80

100

120

Stock Info

CMP 1,653

TP 1,859

Upside 12%

Sector Banking

Market Cap (`cr) 9,31,372

Beta 1.2

52 Week High / Low 1,724/1,177

n HDFC Bank is India's largest private sector bank with a loan book of ₹12 lakh Cr in

H2FY2022 and deposit base of ₹14 lakh Cr. The bank has a very well spread-out book

with wholesale constituting ~54% of the asset book while retail accounted for the

remaining 46% of the loan book

n Q2FY2022 numbers were better than expected as GNPA/ NNPA reduced by 12/8bps

QoQ to 1.35% and 0.40% of advances. Restructured advances at the end of the quarter

stood at 1.5% of advances. The bank posted NII/PPOP/PAT growth of

12.5%/14.4%/17.6% for the quarter on the back of strong loan growth of 15.5% YoY.

NIMs for the quarter were stable sequentially at 4.1%

n The management has indicated that there will be maximum impact of 10-20bps on

asset quality from the restructured pool. Given best in class asset quality and expected

rebound in growth from H2FY2022 we are positive on the bank given reasonable

valuations at 3.2x FY23 adjusted book which is at a discount to historical averages

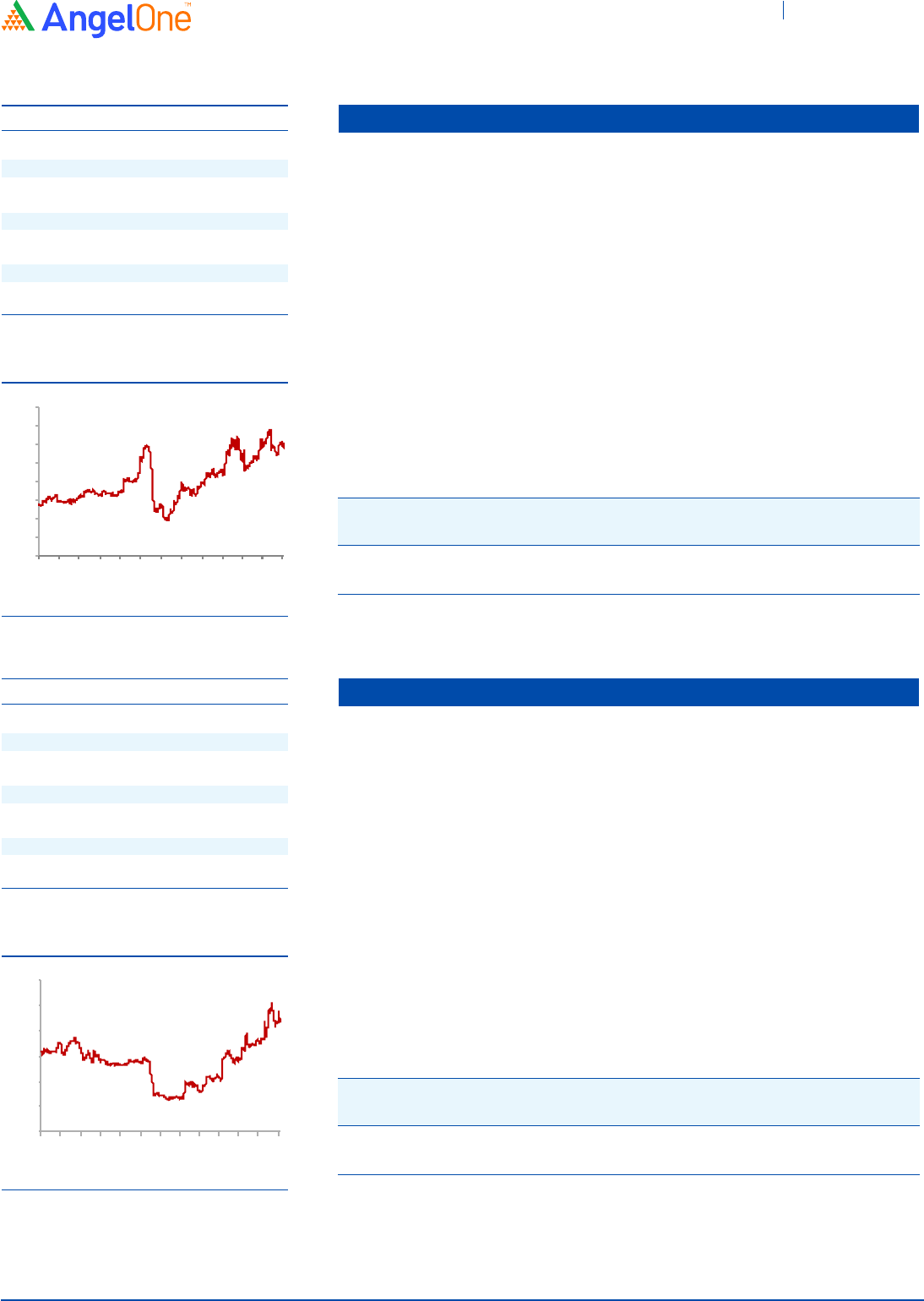

HDFC Bank

3 year-Chart

Source: Company, Angel Research

Key Financials

Source: Company, Angel Research

Y/E NII NIM PAT EPS ABV ROA ROE P/E P/ABV

March (`cr) (%) (`cr) (`) (`) (%) (%) (x) (x)

FY2022E 73,930 4.0 36,213 65.5 419 1.9 16.8 25.2 3.8

FY2023E 86,972 4.1 43,037 77.9 496 2.0 16.9 21.2 3.2

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

Nov-18

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Nov-18

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Top Picks Report November 2021

Diwali Special

November 2021 12

Stock Info

CMP 1,261

TP 1,520

Upside 20%

Sector Banking

Market Cap (`cr) 38,074

Beta 1.4

52 Week High / Low 1,389/722

n AU Small Finance Bank is one of the leading small finance banks with AUM of ~₹34,688

Cr. at the end of Q1FY2022. It has a well-diversified geographical presence across India.

Wheels (auto) and SBL-MSME segment accounting for 37% and 39% of the

AUM respectively

n Collection efficiency remained strong during Jul/Aug/Sep at 110%/107%/109%. Given

stable asset quality, we expect loan growth to pick up in H2FY22 which should lead to a

rerating for the bank

n We expect AU SFB to post robust NII/PPOP/ PAT CAGR of 21.7%/25.1%/26.4% between

FY2020-23 on the back of AUM CAGR of 23.6%. Reducing cost of funds will also help

NIM expansion going forward. We believe that the worst is over for the bank in terms of

asset quality and expect significant improvement in asset quality in H2FY2022 which

should lead to a rerating

AU Small Finance

3 year-Chart

Source: Company, Angel Research

Key Financials

Source: Company, Angel Research

Y/E NII NIM PAT EPS ABV ROA ROE P/E P/ABV

March (`cr) (%) (`cr) (`) (`) (%) (%) (x) (x)

FY2022E 3,004 5.3 1,344 30.5 209.0 1.7 14.1 41.3 5.6

FY2023E 3,635 5.1 1,582 43.4 253.0 1.9 17.1 29.1 4.6

Stock Info

CMP 2,215

TP 3,002

Upside 35%

Sector Banking

Market Cap (`cr) 14,316

Beta 1.3

52 Week High / Low 2,600/766

n Shriram City Union Finance is part of the shriram group and is in the high margin

business of lending to small businesses which account for 57.3% of the loan book as of

end FY2021. The company also provides auto, 2-wheeler, gold, and personal loans

n We expect Shriram City Union to post robust NII/PPOP/ PAT CAGR of

18.3%/19.0%/30.8% between FY2021-23 on the back of AUM CAGR of 14.5%. Reducing

cost of funds will also help NIM expansion going forward. We believe that asset quality

has held up well despite the covid crisis and expect significant improvement in asset

quality in H2FY2022

n We are positive on the company as we believe that the worst is over in terms of asset

quality which along with positive growth momentum should lead to a rerating for the

company

Shriram City Union

3 year-Chart

Source: Company, Angel Research

Key Financials

Source: Company, Angel Research

Y/E NII NIM PAT EPS ABV ROA ROE P/E P/ABV

March (`cr) (%) (`cr) (`) (`) (%) (%) (x) (x)

FY2022E 4,312 12.1 1,372 207.9 1,320.0 3.8 15.6 10.7 1.7

FY2023E 5,036 12.6 1,730 262.2 1,564.2 4.3 16.7 8.1 1.4

-

200

400

600

800

1,000

1,200

1,400

1,600

-

500

1,000

1,500

2,000

2,500

3,000

Nov-18

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Nov-18

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Top Picks Report November 2021

Diwali Special

November 2021 13

Stock Info

CMP 368

TP 425

Upside 15%

Sector Auto

Market Cap (`cr) 4,758

Beta 0.9

52 Week High / Low 399/175

n Suprajit Engineering (SEL), is the largest supplier of automotive cables to the domestic

OEMs with a presence across both 2Ws and PVs. Over the years, SEL has evolved from a

single product/client company in India to have a diversified exposure which coupled

with its proposition of low-cost player has enabled it to gain market share and more

business from existing customers

n SEL has outperformed the Indian Auto industry in recent years (posting positive

growth vs low double-digit declines for the domestic 2W and PV industry in FY21). The

company believes that consolidation of vendors and new client additions would help in

maintaining the trend of market/wallet share gains

n SEL has grown profitably over the years and as a result, it boasts a strong balance sheet

(net cash). We believe SEL is a prime beneficiary of a ramp-up in production by OEMs

across the globe and is well insulated from the threat of EV (is developing new

products). Its premium valuations are justified in our opinion owing to its strong

outlook and top-grade quality of earnings

Suprajit Engg.

3 year-Chart

Source: Company, Angel Research

Key Financials

Source: Company, Angel Research

Y/E Sales OPM PAT EPS ROE P/E P/BV EV/Sales

March (`cr) (%) (`cr) (`) (%) (x) (x) (x)

FY2022E 1,840 14.9 174 12.6 16.7 29.2 4.7 2.8

FY2023E 2,179 15.7 225 16.3 19.4 22.6 4.1 2.4

-

50

100

150

200

250

300

350

400

450

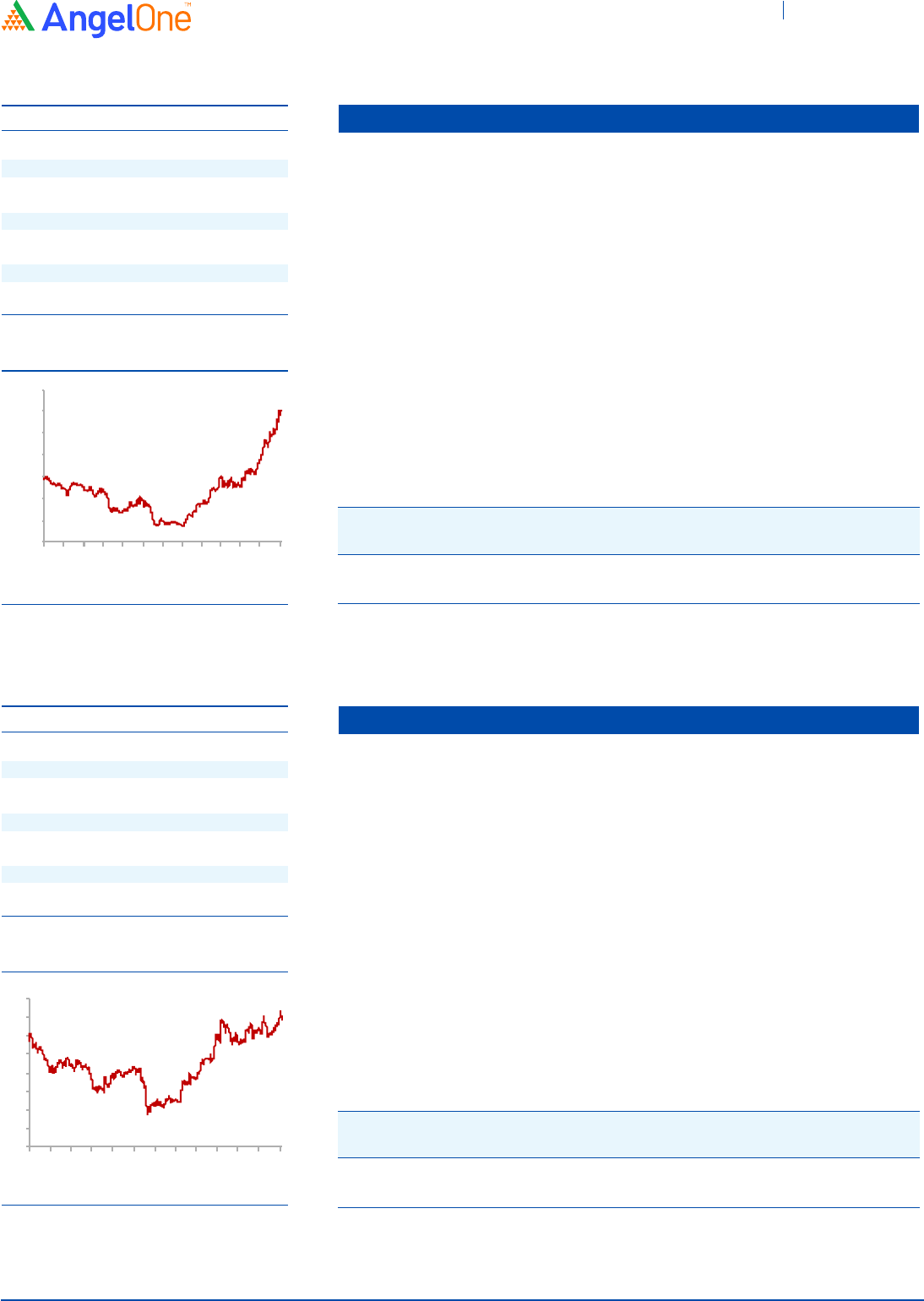

Stock Info

CMP 640

TP 775

Upside 21%

Sector Auto

Market Cap (`cr) 35,974

Beta 1.8

52 Week High / Low 813/295

n Sona BLW is one of India's leading automotive technology companies that derives

~40% of its revenues from Battery Electric Vehicles (BEV) and Hybrid Vehicles. It

supplies EV differential assemblies and gears, BSG systems, and EV traction motors to

global customers. This global BEV segment has been fastest growing and is expected

to maintain high growth rates which are positive for Sona BLW

n Sona BLW has a strong market share ranging from 55-90% for differential gears for PV,

CV, and tractor OEMs in India. The company's combined motor and driveline

capabilities have enabled them to gain market share across its products especially for

products related to EV/BEV

n Given the traction in the BEV/Hybrid Vehicle space, we believe that SonaComstar will

continue to command a higher multiple which is justified by ~49% earning CAGR over

FY21-24E

Sona BLW Precis.

4 Months-Chart

Source: Company, Angel Research

Key Financials

Source: Company, Angel Research

Y/E Sales OPM PAT EPS ROE P/E P/BV EV/Sales

March (`cr) (%) (`cr) (`) (%) (x) (x) (x)

FY2022E 2,171 26.9 335 5.7 23.0 111.3 23.1 17.3

FY2023E 2,997 28.3 500 8.6 28.3 74.7 19.5 12.6

-

100

200

300

400

500

600

700

800

900

Jun-21

Jul-21

Jul-21

Jul-21

Jul-21

Jul-21

Aug-21

Aug-21

Aug-21

Aug-21

Sep-21

Sep-21

Sep-21

Sep-21

Sep-21

Oct-21

Oct-21

Oct-21

Nov-18

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Top Picks Report November 2021

Diwali Special

November 2021 14

Stock Info

CMP 1,192

TP 1,545

Upside 30%

Sector Auto

Market Cap (`cr) 3,846

Beta 0.9

52 Week High / Low 1,260/334

n Ramkrishna Forgings (RKFL), a leading forging player in India and among a select few

having heavy press stands to benefit from a favorable demand outlook for the Medium

& Heavy Commercial Vehicle (M&HCV) industry in domestic and export markets in the

near term

n The company has phased out its CAPEX over the past few years during which it was

impacted by industry slowdown in certain periods. With the end to the CAPEX cycle,

the favorable outlook in the medium term, and sufficient capacity in place, we believe

RKFL volumes would be able to post volume CAGR of 29% over FY21-23E

n RKFL has been able to add new products which have higher value addition. Better mix

along with operating leverage is expected to result in ~550 YoY bps EBITDA margin

improvement in FY22E

Ramkrishna Forg.

3 year-Chart

Source: Company, Angel Research

Key Financials

Source: Company, Angel Research

Y/E Sales OPM PAT EPS ROE P/E P/BV EV/Sales

March (`cr) (%) (`cr) (`) (%) (x) (x) (x)

FY2022E 2,213 23.5 203 63.4 18.6 18.8 3.5 2.2

FY2023E 2,595 23.9 266 83.0 14.7 14.4 2.9 1.8

Stock Info

CMP 143

TP 175

Upside 22%

Sector Auto

Market Cap (`cr) 40,819

Beta 1.5

52 Week High / Low 150/73

n The Ashok Leyland Ltd (ALL) is one of the leading players in the Indian CV industry with

a ~28% market share in the MHCV segment in FY21. The company also has a presence in

the fast-growing LCV segment where it is witnessing marker share gains.

n MHCV segment recovery was delayed due to the 2nd wave but opening up of the

economy along with improvement in business sentiment and increase in Government

spending on infrastructure is likely to boost MHCV demand. The bus segment is also

likely to bounce back going ahead owing to improvement in activities for the end-users

n FY21 MHCV industry production volumes have been at the lowest levels seen in ~12

years and we believe that the company is ideally placed to capture the growth revival in

the CV segment. We believe that ALL will be the biggest beneficiary of the

Government's voluntary scrappage policy and hence rate the stock a BUY.

Ashok Leyland Ltd.

3 year-Chart

Source: Company, Angel Research

Key Financials

Source: Company, Angel Research

Y/E Sales OPM PAT EPS ROE P/E P/BV EV/Sales

March (`cr) (%) (`cr) (`) (%) (x) (x) (x)

FY2022E 21,316 7.0 353 1.2 4.8 118.9 5.7 2.2

FY2023E 30,241 10.5 1,642 5.6 20.9 25.6 5.0 1.5

-

200

400

600

800

1,000

1,200

1,400

-

20

40

60

80

100

120

140

160

Nov-18

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Nov-18

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Top Picks Report November 2021

Diwali Special

November 2021 15

Stock Info

CMP 3,000

TP 3,950

Upside 32%

Sector AgroChemical

Market Cap (`cr) 45,998

Beta 0.9

52 Week High / Low 3,533/1,982

n PI Industries is a leading player in providing Custom synthesis and manufacturing

solutions (CSM) to global agrochemical players. The CSM business accounted for over

70% of the company's revenues in FY21 and is expected to be the key growth driver for

the company in future

n The company has been increasing its' share of high margin CSM business driven by

strong relationship with global agrochemical players. PI is leveraging its chemistry skill

sets and is looking to diversify its CSM portfolio to electronic chemicals, Pharma API,

fluoro chemicals, etc. which will help drive business

n PI Industries has announced that they will be acquiring the API business of Indswift labs

for a consideration of ₹1,500 Cr. Indswift labs had clocked revenues of ₹850 Cr in FY21

and provides PI with an entry into the API business which will help provide the company

with an additional lever to drive growth

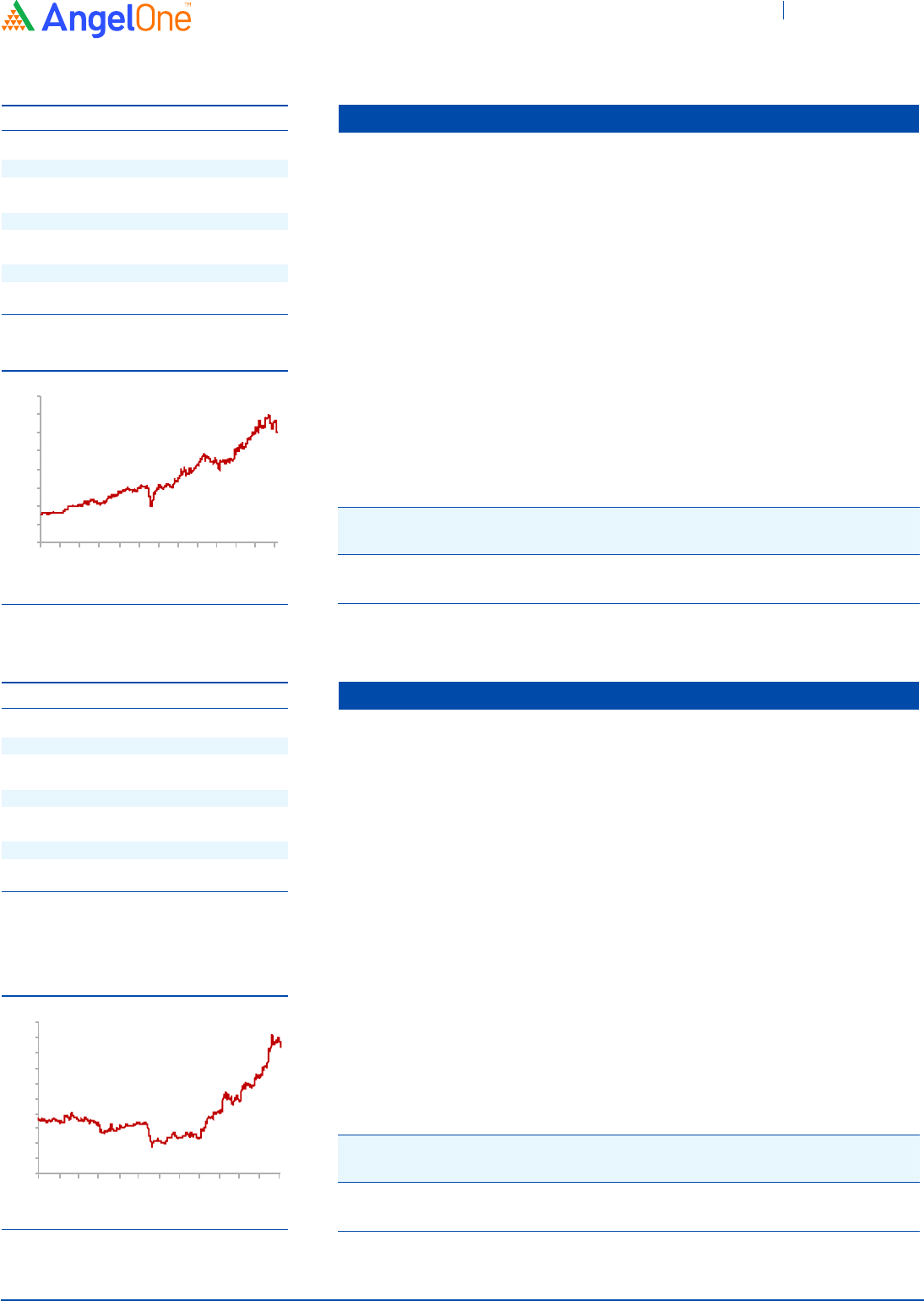

P I Industries

3 year-Chart

Source: Company, Angel Research

Key Financials

Source: Company, Angel Research

Y/E Sales OPM PAT EPS ROE P/E P/BV EV/Sales

March (`cr) (%) (`cr) (`) (%) (x) (x) (x)

FY2022E 5,722 22.8 908 59.8 14.8 50.2 4.2 9.0

FY2023E 7,777 22.8 1,192 78.5 16.5 38.2 3.6 6.6

Stock Info

CMP 868

TP 1,010

Upside 16%

Sector Others

Market Cap (`cr) 16,036

Beta 0.7

52 Week High / Low 957/232

n Carborundum Universal (CUMI) is a leading manufacturer of abrasives, industrial

ceramics, refractories, and electro minerals (EMD) in India having application across

diversified user industries. CUMI is expected to benefit from improving demand

scenarios across its end-user industries such as auto, auto components, engineering,

basic metals, infrastructure, and power

n CUMI has shown good execution in recent quarters with a strong performance in

Abrasives and EMD segments. Within Abrasive, the company is gaining market share

(supply chain issues/preference for Indian suppliers) and should benefit from a good

end-user industry demand. EMD performance is likely to sustain owing to strong

pricing and Volumes (due to the China+1 strategy of its customers)

n Overseas operations have also improved and operations are expected to be at normal

levels. We believe that CUMI's leadership position in the domestic abrasives market,

well-diversified presence, launches of value-added products, and healthy cost

advantages would sustain the improvement in profitability and enhance cash

generation

Carborundum Universal

3 year-Chart

Source: Company, Angel Research

Key Financials

Source: Company, Angel Research

Y/E Sales OPM PAT EPS ROE P/E P/BV EV/Sales

March (``cr) (%) (`cr) (`) (%) (x) (x) (x)

FY2022E 3,167 18.0 380 20.0 16.6 43.3 6.7 4.9

FY2023E 3,667 17.9 444 23.5 16.9 37.0 5.9 4.2

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

-

100

200

300

400

500

600

700

800

900

1,000

Nov-18

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Nov-18

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Top Picks Report November 2021

Diwali Special

November 2021 16

Stock Info

CMP 2,230

TP 2,760

Upside 24%

Sector Others

Market Cap (`cr) 27,681

Beta 0.4

52 Week High / Low 2,777/1,970

n Whirlpool of India (WIL) is engaged in manufacturing and selling of Refrigerators,

Washing Machines, Air Conditioners, Microwave Ovens, built in and Small appliances

and caters to both domestic and international markets

n WIL's products are present in the categories with low penetration levels which in turn

can lead to higher growth for the company. WIL is increasing focus on emerging

categories like water purifier, AC and Kitchen Hoods & Hobs and the company is filling

product portfolio gap by launching products

n Going forward, we expect healthy profitability on back of strong brand, wide

distribution network, capacity expansion& strengthen product portfolio

Whirlpool India

3 year-Chart

Source: Company, Angel Research

Key Financials

Source: Company, Angel Research

Y/E Sales OPM PAT EPS ROE P/E P/BV EV/Sales

March (`cr) (%) (`cr) (`) (%) (x) (x) (x)

FY2022E 6,768 10.5 475 37.5 14.7 59.5 9.0 4.0

FY2023E 7,667 11.5 595 46.9 16.0 47.5 7.8 3.5

Stock Info

CMP 53

TP 64

Upside 21%

Sector Others

Market Cap (`cr) 4,056

Beta 0.9

52 Week High / Low 58/26

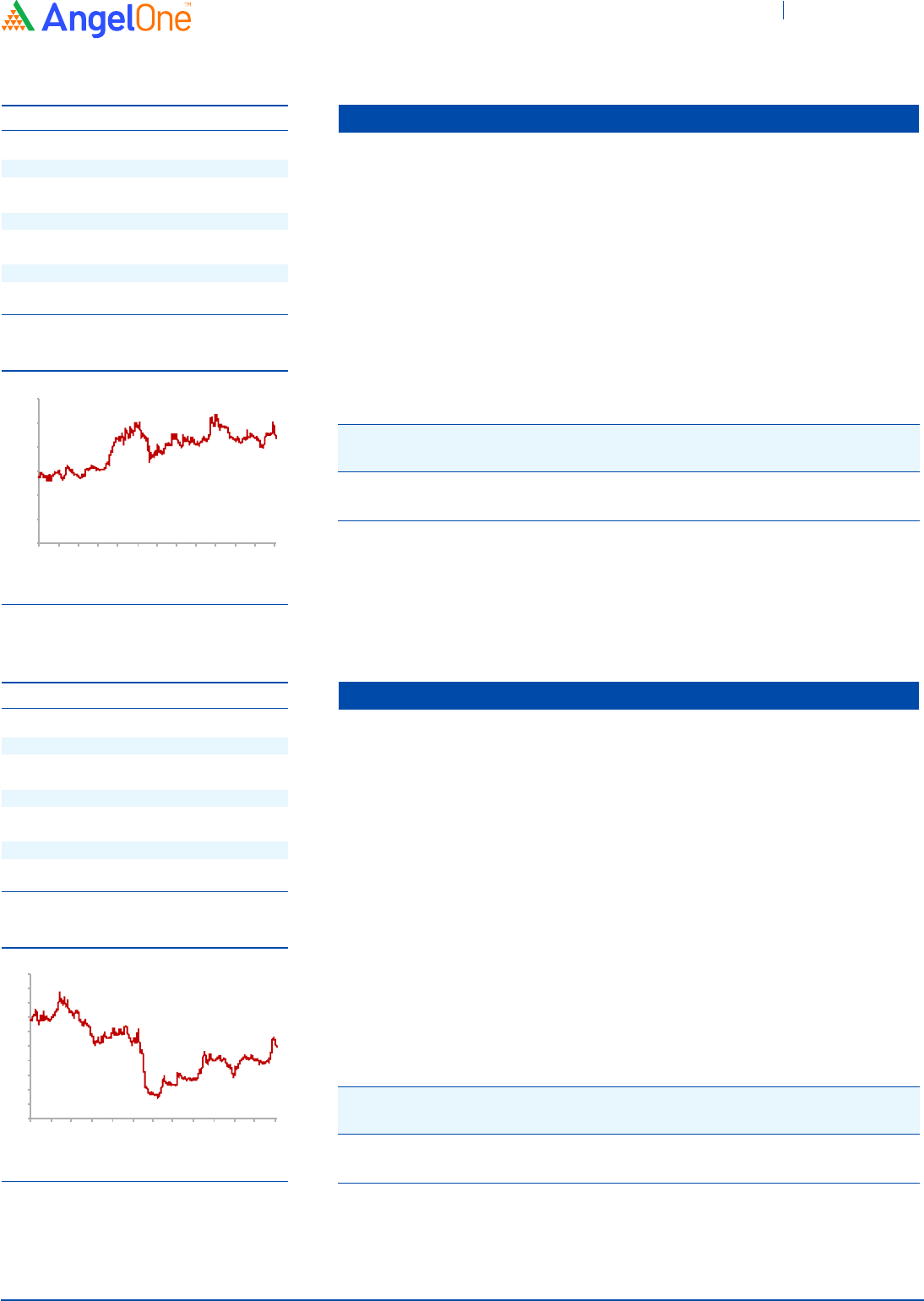

n Lemon Tree Hotels (LTH) is India's largest chain in the mid-priced hotels sector and

third largest overall. This award winning Indian hotel chain opened its first hotel with 49

rooms in May 2004 and operates 87 hotels in 54 destinations with ~8,500 rooms

n Company reported a 129.9% QoQ growth in revenues for Q2FY2022 to `96.9 Cr due to

sharp increase in occupancy levels to 51% from 29.6% in Q1FY2022, while ARR

increased by 28.2% QoQ. This led to a sharp increase of 120.6% in RevPAR sequentially.

As a result, the company posted an EBIDTA of `33.9 Cr for the quarter as compared to

an EBIDTA loss of `0.1Cr. for Q1FY2022

n Occupancy levels which had dropped to 20.0% in May due to the lockdowns have now

been stable at over 50% in Q2FY2022. We expect occupancy levels to improve further

from here on due to the ongoing festive season and improve further in FY2023 thus

driving revenue and profitability back to pre Covid levels in FY2023

Lemon Tree Hotel

3 year-Chart

Source: Company, Angel Research

Key Financials

Source: Company, Angel Research

Y/E Sales OPM PAT EPS ROE P/E P/BV EV/Sales

March (`cr) (%) (`cr) (`) (%) (x) (x) (x)

FY2022E 440 37.5 -90 -0.2 -10.8 - 4.2 11.8

FY2023E 705 45.0 11 0.0 1.3 - 4.1 7.5

-

500

1,000

1,500

2,000

2,500

3,000

-

10

20

30

40

50

60

70

80

90

100

Nov-18

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Nov-18

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Top Picks Report November 2021

Diwali Special

November 2021 17

Stock Info

CMP 853

TP 979

Upside 15%

Sector Others

Market Cap (`cr) 1,807

Beta 0.7

52 Week High / Low 900/401

n Safari Industries (India) Ltd (SIIL) is amongst the leading luggage players with market

share of ~18% market share in the organized sector. Market leader in mass segment &

shift from unorganized to organized sectors would benefit SIIL

n Over the last three years, the company has outperformed luggage Industries in terms

of sales growth. Company has a wide distribution network which would support growth

going ahead. Focused product strategy and diversified product portfolio to boost

growth

n Going forward, we expect SIIL to report strong top-line & Bottom-line growth on the

back of strong growth in the organized sector, wide distribution network, strong brand

& promoter initiatives

Safari Inds.

3 year-Chart

Source: Company, Angel Research

Key Financials

Source: Company, Angel Research

Y/E Sales OPM PAT EPS ROE P/E P/BV EV/Sales

March (`cr) (%) (`cr) (`) (%) (x) (x) (x)

FY2022E 494 7.0 10 4.7 5.6 180.3 10.0 4.0

FY2023E 815 10.0 44 20.1 19.7 42.5 8.2 2.4

Stock Info

CMP 980

TP 1,288

Upside 31%

Sector Others

Market Cap (`cr) 3,195

Beta 1.1

52 Week High / Low 1,135/400

n Stove Kraft Ltd (SKL) is engaged in the business of manufacturing & selling Kitchen &

Home appliances products like pressure cookers, LPG stoves, non-stick cookware

etc. under the brand name of 'Pigeon' and 'Gilma'

n In the Pressure Cookers and Cookware segment, over the last two years, the company

has outperformed Industry and its peers. Post Covid, organized players are gaining

market share from unorganized players which would benefit the player like SKL

n Going forward, we expect SKL to report healthy top-line & bottom-line growth on the

back of new product launches, strong brand name and wide distribution network

Stove Kraft

8-Months Chart

Source: Company, Angel Research

Key Financials

Source: Company, Angel Research

Y/E Sales OPM PAT EPS ROE P/E P/BV EV/Sales

March (`cr) (%) (`cr) (`) (%) (x) (x) (x)

FY2022E 1,057 10.6 68 21.1 18.6 46.4 8.6 4.7

FY2023E 1,248 11.4 94 29.0 20.4 33.8 6.9 3.5

-

100

200

300

400

500

600

700

800

900

1,000

-

200

400

600

800

1,000

1,200

Feb-21

Mar-21

Apr-21

May-21

Jun-21

Jul-21

Aug-21

Sep-21

Oct-21

Nov-18

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Top Picks Report November 2021

Diwali Special

November 2021 18

Stock Info

CMP 3,450

TP 4,150

Upside 20%

Sector Others

Market Cap (`cr) 11,428

Beta 0.5

52 Week High / Low 3,788/2,081

n Amber Enterprises India Ltd. (Amber) is the market leader in the room air conditioners

(RAC) outsourced manufacturing space in India. Amber would outperform the industry

due to dominant position in Room AC contract manufacturing, increase in share of

business from existing customers and new client additions

n Amber plans to increase revenues from component business (by increasing product

offerings, catering to newer geographies, adding new clients) and exports (already

started in the Middle east). In the past 2–3-year, Amber has acquired companies like IL

JIN Electronics, Ever and Sidwal Refrigeration Industries, which would help in

backward integration and help the company to foray into different segments like

railway, metro and defense

n Going forward, we expect healthy profitability on the back of foray into the Commercial

AC segment, entry into export markets and, participation in the PLI scheme

Amber Enterp.

3 year-Chart

Source: Company, Angel Research

Key Financials

Source: Company, Angel Research

Y/E Sales OPM PAT EPS ROE P/E P/BV EV/Sales

March (`cr) (%) (`cr) (`) (%) (x) (x) (x)

FY2022E 4,004 7.1 150 45.4 8.6 76.0 6.3 2.7

FY2023E 5,620 8.6 262 78.9 13.1 43.7 5.5 2.0

Stock Info

CMP 765

TP 950

Upside 24%

Sector Others

Market Cap (`cr) 7,390

Beta 1.4

52 Week High / Low 900/240

n Company operates in Residential & Commercial real-estate along with Contractual

business. Companies 70% of residential pre-sales come from the Bangalore market

which is one of the IT hubs in India, we expect new hiring by the IT industry will increase

residential demand in the South India market

n Ready to move inventory and under construction inventory levels have moved down to

its lowest levels. Customers are now having preference towards the branded players

like Sobha Developers

n Company expected to launch 17 new projects/phase spread over 12.56mn sqft across

various geographies. Majority of launches will be coming from existing land banks.

Company having land bank of approx. 200mn Sqft of salable area

Sobha

3 year-Chart

Source: Company, Angel Research

Key Financials

Source: Company, Angel Research

Y/E Sales OPM PAT EPS ROE P/E P/BV EV/Sales

March (`cr) (%) (`cr) (`) (%) (x) (x) (x)

FY2022E 2,450 19.7 123 12.9 7.5 59.3 2.7 4.0

FY2023E 3,550 22.5 355 37.4 12.9 20.5 2.4 2.7

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

-

100

200

300

400

500

600

700

800

900

1,000

Nov-18

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Nov-18

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Top Picks Report November 2021

Diwali Special

November 2021 19

Stock bought in last 6 Months

Stock Name Date Reco Price

Godrej Propert. 4-Jun-21 BUY 1,420

SuprajitEngg. 8-Jun-21 BUY 288

L & T Infotech 11-Jun-21 BUY 4,060

Jindal Steel 14-Jun-21 BUY 420

Quess Corp 16-Jun-21 BUY 840

Stove Kraft 21-Jun-21 BUY 578

Galaxy Surfact. 7-Jul-21 BUY 3,135

AU Small Finance 9-Jul-21 BUY 1,148

DalmiaBharatLtd 15-Jul-21 BUY 2,218

Safari Inds. 19-Jul-21 BUY 742

HDFC Bank 5-Aug-21 BUY 1,490

Sona BLW Precis. 25-Aug-21 BUY 484

Bajaj Electrical 27-Aug-21 BUY 1,189

Sobha 31-Aug-21 BUY 627

P I Industries 9-Sep-21 BUY 3,420

Amber Enterp. 14-Sep-21 BUY 3,243

Sobha 22-Sep-21 BUY 729

Lemon Tree Hotel 23-Sep-21 BUY 43.25

Whirlpool India 29-Sep-21 BUY 2,299

RamkrishnaForg. 13-Oct-21 BUY 1,220

Source: Company, Angel Research

Stock sold in last 6 Month

Stock Name Date Reco Price

NRB Bearings 8-Jun-21 EXIT 131.600

Galaxy Surfact. 15-Jun-21 EXIT 3,086

LIC Housing Fin. 16-Jun-21 EXIT 497

PVR 29-Jun-21 EXIT 1,355

Quess Corp 15-Jul-21 EXIT 751

Apollo Hospitals 27-Jul-21 EXIT 4,100

IDFC First Bank 5-Aug-21 EXIT 47

Galaxy Surfact. 18-Aug-21 EXIT 2,997

Jindal Steel 23-Aug-21 EXIT 362

Godrej Propert. 25-Aug-21 EXIT 1,437

Escorts 31-Aug-21 EXIT 1,348

Sobha 7-Sep-21 EXIT 780

Crompton Gr. Con 14-Sep-21 EXIT 484

DalmiaBharatLtd 22-Sep-21 EXIT 2,143

Bajaj Electrical 24-Sep-21 EXIT 1,499

L & T Infotech 27-Sep-21 EXIT 5,950

GNA Axles 19-Oct-21 EXIT 1,076

Source: Company, Angel Research

Top Picks Report November 2021

Diwali Special

November 2021

20

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel One Limited (formerly known as Angel Broking Limited) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity & Derivatives

Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has

registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research Analyst in terms of SEBI

(Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been debarred/ suspended by

SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any

compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in

this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an

investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general

guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may

arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has not independently verified all

the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to

the accuracy, contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable basis the

information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information.

Ratings (Based on expected returns Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

over 12 months investment period): Reduce (-5% to -15%) Sell (< -15%)

Hold (Fresh purchase not recommended)

Disclosure of Interest Statement Top Picks

1. Financial interest of research analyst or Angel or his Associate or his relative No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives No

3. Served as an officer, director or employee of the company covered under Research No

4. Broking relationship with company covered under Research No

Top Picks Report November 2021

Diwali Special

November 2021 21

6th Floor, Ackruti Star, Central Road, MIDC, Andheri(E), Mumbai - 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Amarjeet Maurya Senior Lead Analyst [email protected]

Angel One Limited (formerly known as Angel Broking Limited), Registered Office: G-1, Ackruti Trade Center, Road No. 7, MIDC, Andheri (E),

Mumbai - 400 093. Tel: (022) 6807 0100.Fax: (022) 6807 0107, CIN: L67120MH1996PLC101709, SEBI Regn. No.: INZ000161534-BSE Cash/F&O/CD

(Member ID: 612), NSE Cash/F&O/CD (Member ID: 12798), MSEI Cash/F&O/CD (Member ID: 10500), MCX Commodity Derivatives (Member ID:

12685) and NCDEX Commodity Derivatives (Member ID: 220), CDSL Regn. No.: IN-DP-384-2018, PMS Regn. No.: INP000001546, Research Analyst

SEBI Regn. No.: INH000000164, Investment Adviser SEBI Regn. No.: INA000008172, AMFI Regn. No.: ARN–77404, PFRDA Registration

No.19092018.Compliance officer: Ms. Richa Ghosh, Tel: (022) 39413940 Email: [email protected]

Technical and Derivatives: